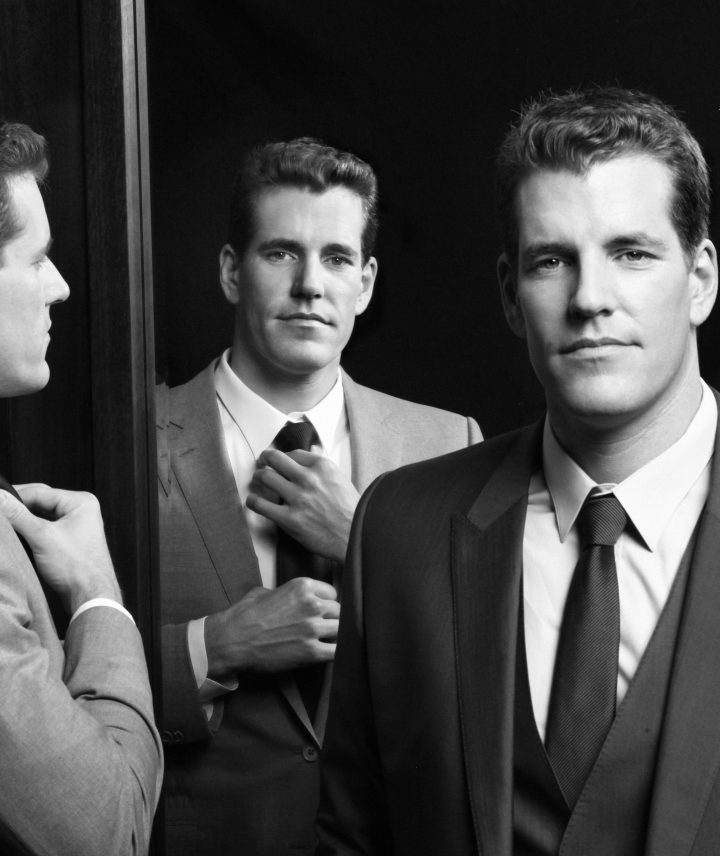

ANYONE WITH A STUDENT LOAN knows the system sucks. It’s expensive; it’s confusing. It’s what Mike Cagney, CEO and cofounder of a social finance company called SoFi, has dedicated his life to fixing.

“What’s happened is that the cost of education [in the United States] has ramped up faster than inflation,” Cagney explains. “It’s to the point where… it isn’t always worth the value.”

This isn’t news: Skyrocketing tuition has forced students to borrow exorbitant amounts. So, even though interest rates are at a historical low, school still costs more than ever. And with around $1 trillion owed, student debt is a national epidemic surpassing both credit cards and auto loans. (We’d suggest a sorrow-drowning cocktail, but many victims aren’t old enough to drink.)

“And these individuals will never be able to buy a home — never be able to do the same things their parents did having not had this debt,” Cagney concludes. “It’s crushing.”

We can ask schools to charge less, but the real issue is that lenders like Sallie Mae charge “one-size-fits-all,” fixed interest rates. SoFi disrupted that model by allowing borrowers to refinance that debt into a lower rate after graduation, saving an average of $19K per student. And while the idea of refinancing isn’t exactly new, it’s the way SoFi refinances: They underwrite borrowers based on where they went to school, what their degree is and their income. For the first time ever, based on their belief in you to succeed.