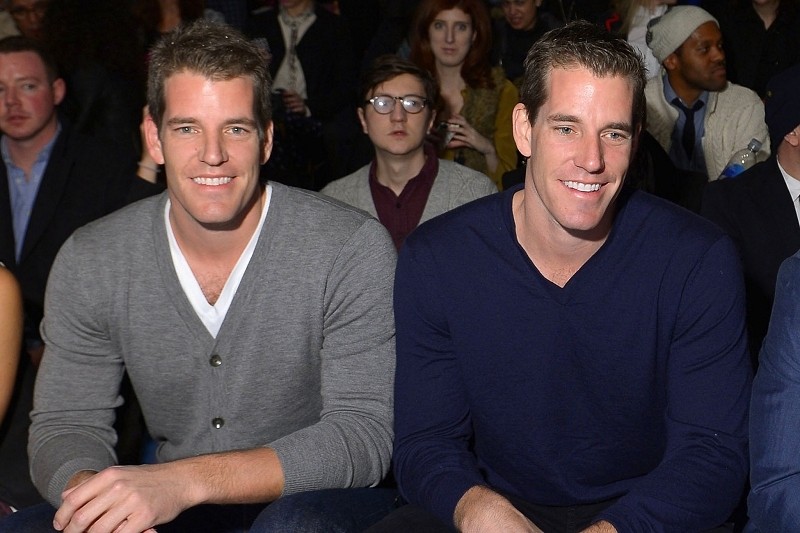

We arrive at Winklevoss Capital on a sunny January Wednesday, asking the twin entrepreneurs to explain bitcoin in a way that actually makes sense. Their answer? It’s simply digital money—money obtained either through a software-run equation, a process called mining, or by exchanging money, goods or other services with people who already own bitcoin.

“From the moment bitcoin first appeared in 2008, we were fascinated,” Cameron explains. “But the issue was, Tyler and I had to jump through rings of fire to buy bitcoin—send large amounts of money to unregulated overseas exchanges… No average person would take that risk.”

It’s why the 35-year-olds created Gemini, the United States’s first licensed exchange for buying and selling bitcoin. They’ve made the currency as safe and easy to access as stock on the NASDAQ, attempting to bring into the popular culture of finance.

But does the average person really need to own bitcoin? Should we care that it’s now more accessible? The Winklevii make their case.